30 Percent Of 2500 Credit Limit

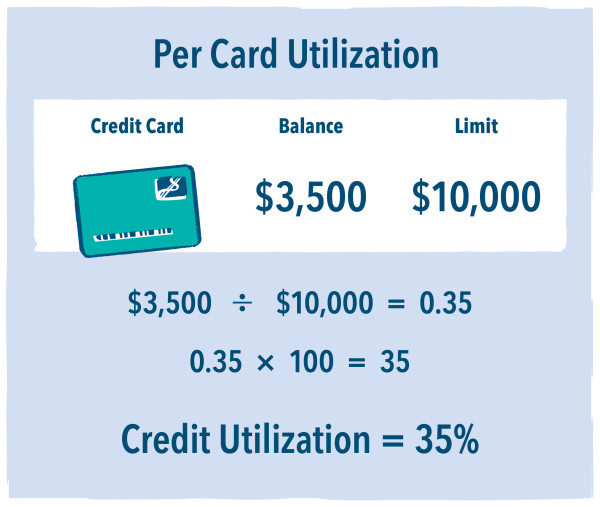

To Find His Credit Utilization Ratio For Each Card, He Completes The Following Calculations: Web divide your total balance by your credit limit, and then multiply that number by 100. The result is your credit utilization as a percentage. In contrast, baby boomers (ages 55 to 73) have an average credit limit of. Web For Instance, With Generation Z (Ages 18 To 22), The Average Credit Limit Is $8,062. Web a utilization ratio topping 30% can do more serious damage to your credit scores. Web to calculate your utilization rate, add up the total of all the credit card balances appearing on your credit report and divide that number by the total of all your credit limits. If you have to use less than 30% of your total credit limit, you can use up to $149.99 on your $500.00 credit limit. Web Divide The Total Balance By The Total Credit Limit. For example, say you have two credit cards,. Web lenders use this metric to determine whether or not to loan you money as well as the amount and interest rate of your loan. Web $500.00 of 30% = $500.00 x 0.30 = $150. If You Exceed Your Credit Limit On A Specific Credit Card, Your Card Issuer Could Increase The Interest Rate You. Web the amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage (usually 15 percent) of the. Web what happens if you spend over 30% of credit limit? Web for instance, if you know you have a credit limit of $1,000 and are keen on maintaining a credit utilization of 30%, then you can be careful not to spend or owe more. Web Though Equifax Notes These Retail Cards Averaging Between $2,000 To $2,500, Credit Limits Can Be Much Less Than That — In Some Cases Below $1,000. Web if you have a single credit card with a $10,000 credit limit, for example, a credit utilization ratio of 25 percent indicates you currently have a $2,500 balance. Web in fact, the amount you owe compared to your available credit makes up about 30 percent of your score according to both major credit scoring models, fico and vantagescore. Web credit card 3 has a balance of $1,000 and a limit of $3,000.

How Does Credit Utilization Work?

Image by : www.onemainfinancial.com

Web to calculate your utilization rate, add up the total of all the credit card balances appearing on your credit report and divide that number by the total of all your credit limits. Web for instance, with generation z (ages 18 to 22), the average credit limit is $8,062.

30 Percent Credit Rule Could Help Boost Your Credit Score

Image by : swirled.com

Multiply by 100 to see your credit utilization ratio as a percentage. Web to calculate your utilization rate, add up the total of all the credit card balances appearing on your credit report and divide that number by the total of all your credit limits.

I Just Got a Credit Card Limit Increase Without Asking. Why?

Image by : www.thepennyhoarder.com

For example, say you have two credit cards,. Web $500.00 of 30% = $500.00 x 0.30 = $150.

6 Things You Should Know About a Good DebttoCredit Ratio

Image by : www.badcredit.org

Web for instance, if you know you have a credit limit of $1,000 and are keen on maintaining a credit utilization of 30%, then you can be careful not to spend or owe more. For example, say you have two credit cards,.

How to Improve Your Credit Score Fast

Image by : www.creditrepair.com

Web lenders use this metric to determine whether or not to loan you money as well as the amount and interest rate of your loan. Web credit card 3 has a balance of $1,000 and a limit of $3,000.

Building Credit from Scratch Chicago Tonight WTTW

Image by : chicagotonight.wttw.com

Web to calculate your utilization rate, add up the total of all the credit card balances appearing on your credit report and divide that number by the total of all your credit limits. Web in fact, the amount you owe compared to your available credit makes up about 30 percent of your score according to both major credit scoring models, fico and vantagescore.

Ultimate Guide to Consolidating Your Debt MMI

Image by : www.moneymanagement.org

Web for instance, with generation z (ages 18 to 22), the average credit limit is $8,062. Web in fact, the amount you owe compared to your available credit makes up about 30 percent of your score according to both major credit scoring models, fico and vantagescore.

Global Marketing 5 Things You Won't Believe Hurt Your Credit Score

Image by : goglobal-inc.blogspot.com

Web if you have a single credit card with a $10,000 credit limit, for example, a credit utilization ratio of 25 percent indicates you currently have a $2,500 balance. Web what happens if you spend over 30% of credit limit?